01 / 28 / 25

Decree granting tax incentives to support the national strategy called “Plan Mexico”, to promote new investments, to encourage dual training programs and fostering innovation.

MEXICO CITY, MEXICO, January 28th, 2025 – On January 21, 2025, the “Decree granting tax incentives to support the national strategy called “Plan Mexico”, to promote new investments, which encourage dual training programs and fosters innovation, was published in the Federal Official Gazette (Diario Oficial de la Federación or DOF), which will remain in force from January 22, 2025 to September 30, 2030, leaving without effect the one published on October 11, 2023 and its modification published on December 24, 2024 (Repealed Decree).

By way of background, on January 13, 2025, the President of Mexico presented the national strategy called “Plan Mexico”, which establishes, among other goals, to: (i) strengthen the national industry for the local/regional market; (ii) expand import substitution with value chains; (iii) generate jobs; and, (iv) strengthen scientific and technological development and innovation.

Taking the above into account, through the Decree two tax incentives are granted, which consist of the following:

A. Beneficiaries of tax incentives.

The beneficiaries of the tax incentives are legal entities that pay taxes under the general regime and legal entities that are taxed under the Simplified Trust Regime (Régimen Simplificado de Confianza), as well as individuals with business and professional activities.

Beneficiaries may choose to apply the tax incentives provided for in the Decree, as long as they meet, among others, the following requirements:

a) Be registered before the Federal Taxpayers Registry (Registro Federal de Contribuyentes) and have the Tax Mailbox (Buzón Tributario) enabled;

b) To have an opinion on compliance with tax obligations in a positive sense;

c) Submit an investment project, a collaboration agreement entered into with the Ministry of Public Education (Secretaría de Educación Pública) in the field of dual education, or an investment project for the development of the invention or for the initial certification, as the case may be;

d) Have proof of compliance issued by the Evaluation Committee (Committee) to apply the tax incentives of the Decree; and,

e) Comply with the guidelines issued by the Committee for this purpose.

B. Tax Incentives.

- Immediate deduction incentive.

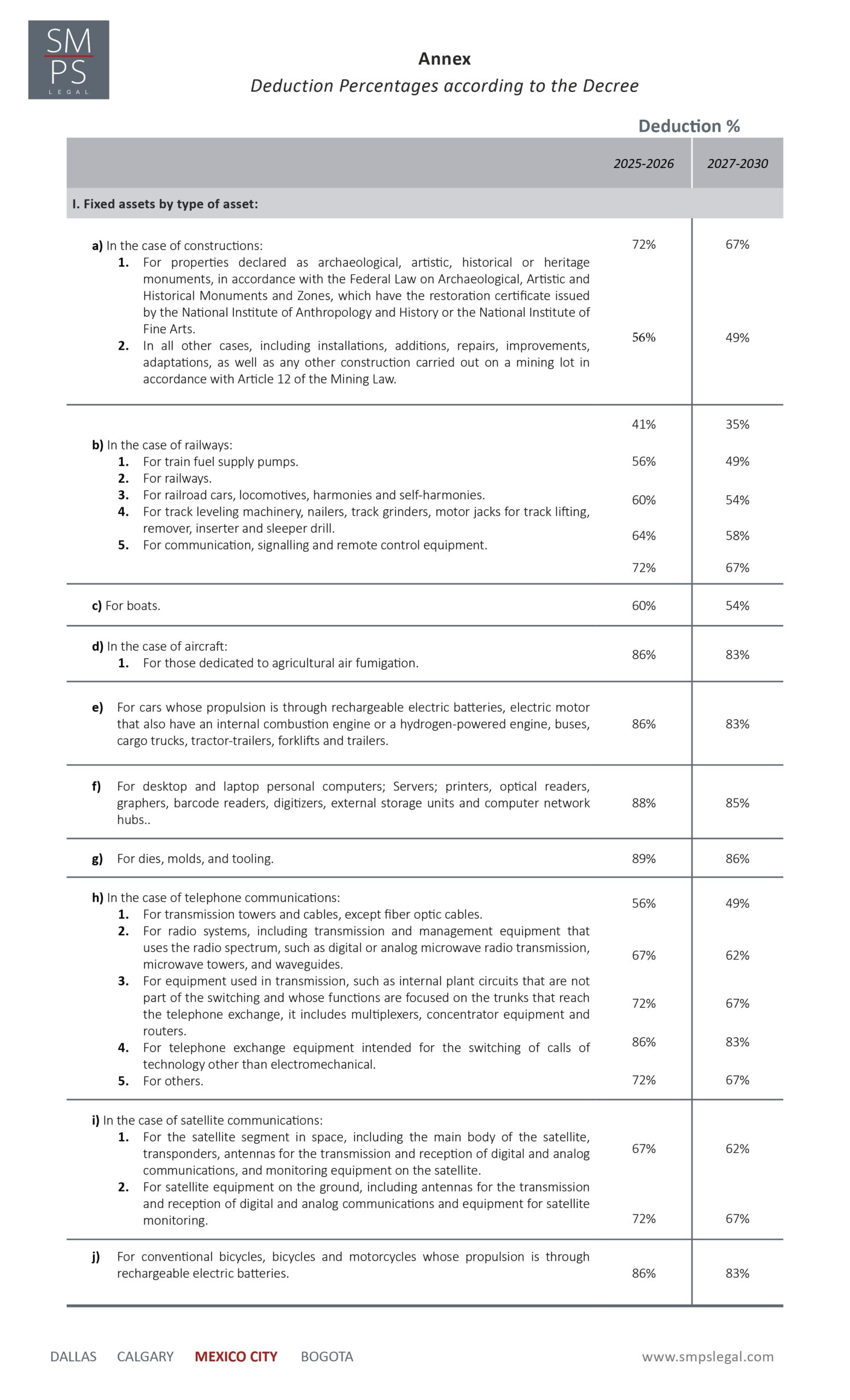

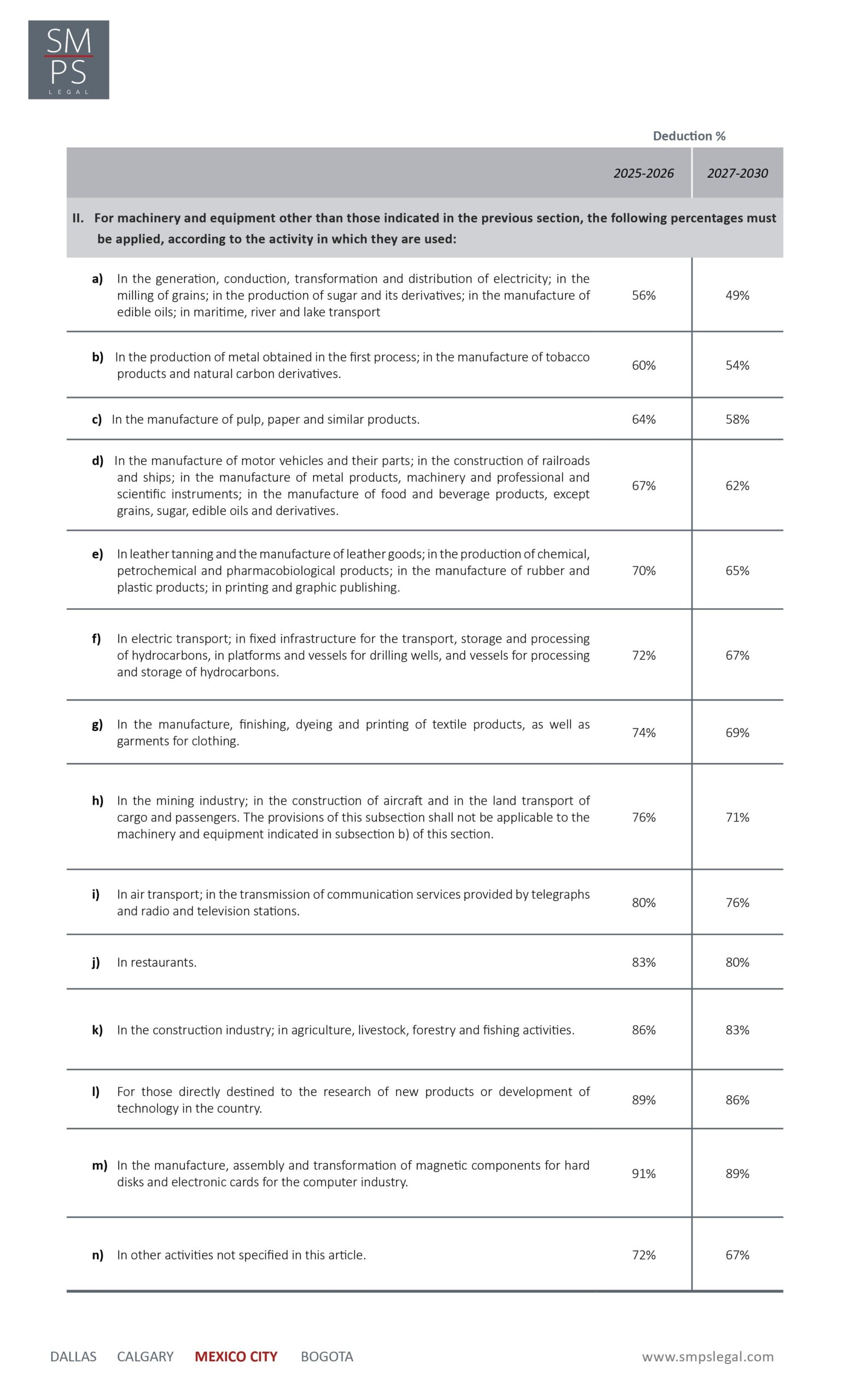

The first tax incentive provided for in the Decree allows the immediate deduction of new fixed assets used for the first time in Mexico, acquired from January 22, 2025 to September 30, 2030, considering the percentages listed in the Annex, instead of those indicated in the Income Tax Law (Ley del Impuesto sobre la Renta or LISR). The excess of the resulting amount will be deductible only when the assets are alienated, lost or cease to be useful in accordance with the provisions of the Decree.

As an example, we can consider constructions whose deduction per cent ranges from 56% for the years 2025 and 2026 or 49% for the years 2027 to 2030.

- 1 Application requirements.

- It shall not be applicable in the case of office furniture and equipment, automobiles powered by internal combustion engines, automobile armoring equipment, or any fixed asset not individually identifiable, or in the case of aircraft other than those dedicated to agricultural air fumigation.

- Beneficiaries must maintain the use of the investments made for a minimum period of two years following their immediate deduction, unless they are lost due to a fortuitous event or force majeure.

- Beneficiaries must keep a record of the investments for which they applied the tax incentive that contains: (i) a description of the type of asset in question, (ii) the relationship with the main activity, (iii) the process or activity in which it was used, (iv) the percentage of deduction applied, (v) the fiscal years in which the deduction was considered and, where applicable, and (vi) date of sale, loss or that it ceased to be useful, due to a fortuitous event or force majeure.

- For value added tax purposes, the expenditure is considered deductible, so the corresponding tax may be credited.

- When engaged in more than one activity, the beneficiary may apply the percentage that corresponds to the activity for which he or she obtained the highest income in the year in which the incentive is applied.

- The beneficiaries will apply the tax incentive only in the case of the investment of new fixed assets, the acquisition of which is intended for their exclusive use for the development of their activities.

- The Original Amount of the Investment (Monto Original de la Inversión) may be updated for inflation, considering the indexes set forth in the Federal Tax Code (Código Fiscal de la Federación or CFF).

- The Decree incorporates depreciation rules applicable to assets that are disposed of, lost or cease to be useful, taking into account, among others, the number of years that have elapsed since the immediate deduction was made and the percentage of immediate deduction applied.

- The total income received is considered to be the gain obtained from the sale of the assets.

- For the determination of the monthly provisional income tax payments, the beneficiaries must calculate the profit coefficient of such payments, adding the tax profit or reducing the tax loss of the corresponding years, as the case may be, with the amount of the deduction corresponding to the tax incentive; however, in each provisional payment, they may reduce the monthly tax profit with the amount of the immediate deduction made in the same year.

- Additional deduction for training and innovation expenses.

A different tax incentive is granted, consisting of an additional deduction equivalent to 25% of the increase in expenditures made for: (i) training of workers in the year, or (ii) for innovation expenses. The incentive will be applicable from 2025 to 2030. The amount deducted for this concept may not exceed the income obtained in the year, so the application of the same will not give rise to a tax loss.

The Decree defines Training as providing technical or scientific knowledge related to the taxpayer’s activity, provided to its workers registered before the Mexican Social Security Institute (Instituto Mexicano del Seguro Social), and Innovation Expenses as those linked to investment projects for the development of the invention that allows obtaining patents and those investment projects that are developed to obtain initial certifications required by the beneficiaries for their integration into local/regional supply chains.

In connection with the application of this second incentive, the Decree states the following:

- Beneficiaries who do not apply the additional deduction in the year in which they make the expense will lose the right to do so in subsequent years.

- The tax incentive will not be cumulative for the purposes of the LISR.

- Taxpayers must keep a specific record of the training or investment projects for the development of the invention or initial certification.

C. Additional considerations.

For the purpose of applying the tax incentives provided for in the Decree, the Committee is created and will determine for each fiscal year the maximum amount that the beneficiaries may apply for each of the tax incentives in accordance with the guidelines issued by said committee.

On the other hand, the Tax Administration Service (Servicio de Administración Tributaria or SAT) is empowered to issue the general rules necessary for the due and correct application of the Decree.

D. Impediments to the application of tax incentives.

Finally, it is established that those taxpayers who are in any of the following cases will be prevented from applying the tax incentives:

a) They are located in any of the cases established in article 69, penultimate paragraph, of the CFF, among others: (i) they have firm or unsecured tax credits, (ii) they are not located, (iii) they have a final conviction for a tax crime, etc.

b) They are definitively listed as EFOS taxpayers, or one of their partners or shareholders is in this case. Nor will it be applicable to taxpayers who have carried out transactions with EFOS taxpayers and have not proved before the tax authorities the operations covered by the corresponding Digital Tax Receipts (Comprobantes Fiscales Digitales por Internet or CFDI).

c) The presumption of having unduly transferred tax losses has been applied to them.

d) They do not comply with any of the requirements established in the Decree.

e) They are in the liquidation exercise.

f) They are in the procedure of temporary restriction of the use of digital stamps for the issuance of CFDI.

g) They have canceled the certificates issued by the SAT for the issuance of CFDI.

(h) They do not comply with the provisions of the guidelines issued by the Committee for this purpose.

In addition to the above, the beneficiaries who have applied the tax incentives provided for in the Decree and do not comply with the requirements established therein, must pay the tax, the update and the corresponding surcharges, in accordance with the applicable legal provisions, and the tax incentives must be annulled.

Finally, we do not fail to warn that taxpayers who have acquired new fixed assets, as well as those who have incurred training expenses prior to the entry into force of the Decree and who are applying the provisions of the Repealed Decree, will continue to apply them until their full conclusion.