06 / 05 / 23

Mexico and the Nearshoring

Investing Opportunities

I. Introduction

An increase in transportation and logistics costs derived from the COVID-19 pandemic, the environmental costs related to maintain interoceanic supply chains and geopolitical tensions between the United States (US), China and Russia have resulted in the need to have suppliers close to manufacturing facilities. More and more companies have been relocating their production capabilities next to consumer markets such as the U.S., reconfiguring global value chains and optimizing supply chains, especially from Asia, in order to supply parts and components practically immediately to manufacturing centers. This phenomenon is called “Nearshoring”.

Mexico is a boarder state with the US and part of the free trade agreement (“FTA”) with the US and Canada (USMCA), and has in place 13 other free trade agreements covering 48 countries. In addition to its geographic location to one of the largest consumer centers in the world, labor force in Mexico is very qualified and competitive at lower costs. Moreover, the commercial bonds developed by Mexico with North America during the last 30 years and the legal framework supporting such relationship makes Mexico a big strategic production opportunity.

Furthermore, US President Joe Biden signed on August 9, 2022 the CHIPS and Science Act that seeks supply chain resilience strategy, aiming to secure reliable supply in four strategic sectors:

1. Semiconductors manufacturing and advance packaging;

2. High capacity batteries;

3. Critical minerals and rare earth elements; and

4. Pharmaceuticals and active pharmaceutical ingredients.

II. Mexico and the Nearshoring

As mentioned above, Mexico has been familiar with the Nearshoring concept when its government promoted the manufacturing (maquila) industry and later on, in 1994, such effort was consolidated with the North American Free Trade Agreement (NAFTA). Due to its geographic location, its network of FTA´s, manufacturing and export promotion programs, its relatively low salaries and the high skills of its workforce, among other circumstances, Mexico has established itself as an attractive destination for companies wishing to relocate their operations in our region.

Today Mexico is integrated into the productive chains of different regions of the world, including North, Central and South America, Europe, Asia and Oceania. The FTA´s signed by Mexico allow the import of goods that comply with the rules of origin established in each treaty, under tariff preferences, and within a framework of legal and institutional certainty.

Regardless of the tariff preferences that may be applied under the FTAs when the goods qualify as originated in the region, Mexico also has programs that promote the import, manufacture and export of goods (mainly the IMMEX Program and the PROSEC Program).

The IMMEX Program allows the temporary import of goods necessary to be used in an industrial or service process for the manufacture, transformation, or repair of goods of foreign origin imported temporarily for export or for the provision of export services, without payment of the general import tax and other taxes (e.g., value-added tax).

The Sector Promotion Programs (PROSEC) allow producers of certain goods to import at a preferential rate of the General Import Tax several goods to be used in the production of specific products. The goods produced may be destined for the domestic market and do not need to be exported.

Finally, another instrument to promote manufacturing is the Eighth Rule under which companies are allowed to import machinery and equipment, materials, inputs, parts and components in order to obtain administrative facilities and preferential tariffs.

During 2023, investments in Mexico have substantially increased in sectors related to the Nearshoring phenomenon, such as automotive, railroads infrastructure and industrial facilities.

Through its solid network of FTS´s and programs to promote manufacturing and merchandise exports, Mexico represents an attractive destination for companies seeking to integrate into global production chains, especially due to its unique commercial and geographic relationship with the US.

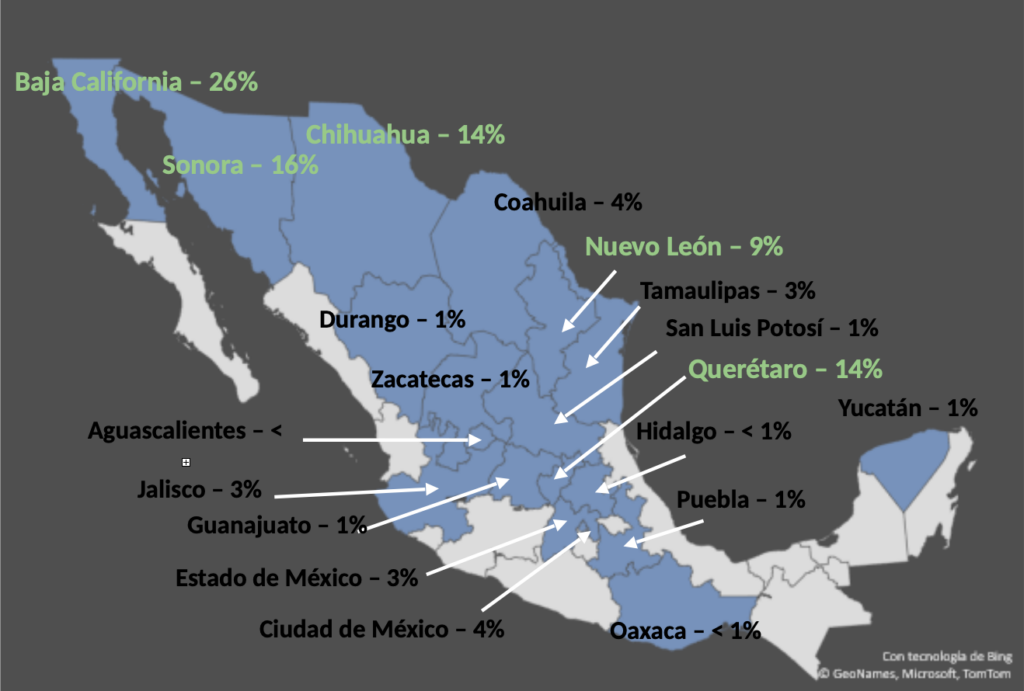

III. Geographical distribution of the Aerospace Industry in Mexico

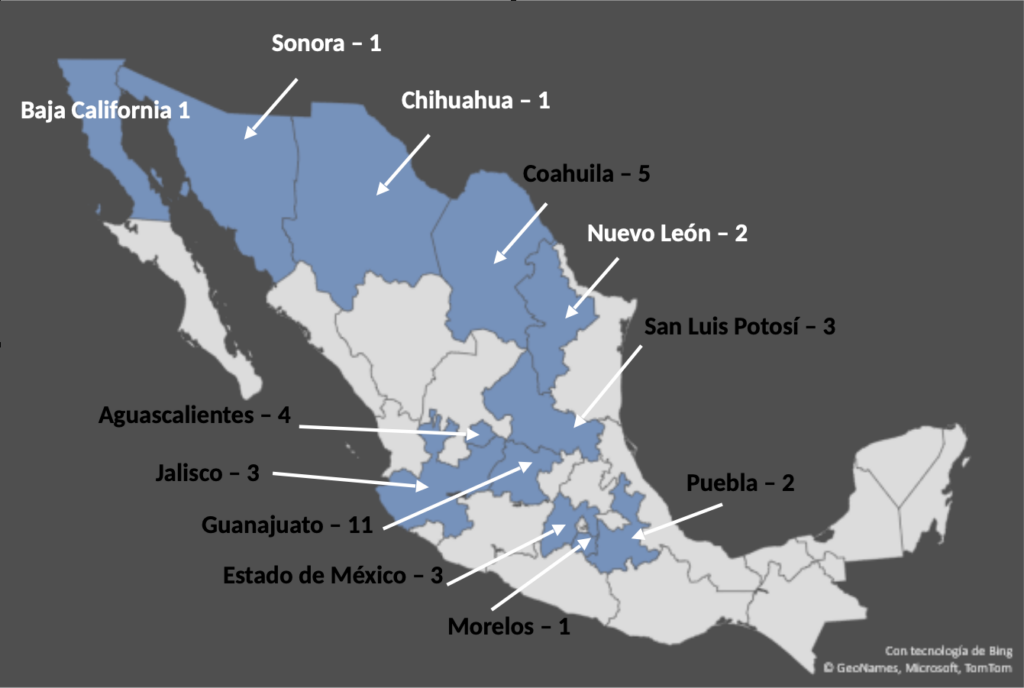

IV. Geographical distribution of Vehicle, Engine and Transmission Assembly Plants

Source: https://www.amia.com.mx/about/plantas_ensamble/

V. Companies that settled operations in Mexico attracted by the Nearshoring

Since 2022, several companies announced their interest in establishing operations in Mexico due to the relocation of the supply chain, which is the major reason of the nearshoring phenomenon. According to the information provided by the “Excelsior” journal, 450 companies are looking for investing in Mexico, out of which 60% are Asian companies seeking to approach the North American region.

Listed below are some of the most important companies that have recently invested or established business operations in the country:

- Schneider Electric

- Tesla

- Cuprum

- Tenere

- Daye

- Noah Itech

- American Woodmark

- Daewon Chemical

- Gefit

- Hengli

- Lens Technology

- Item México

- Odata

- SEVCO México

- Layer 9

- Maq Draq

- Thyssenkrupp Components Technology

- Hisense

- Kuka Home

- Sunon Forniture

- HangzhouXZB

- Skyish

Source:

- https://mexicoindustry.com/noticia/sabias-que-la-industria-aeroespacial-en-mexico-esta-conformada-por-386-empresas

- https://www.excelsior.com.mx/dinero/nearshoring-hay-450-proyectos-de-inversion/1570056

- https://www.somosindustria.com/articulo/nearshoring-atrae-empresas-a-mexico/#:~:text=Algunas%20de%20las%20nuevas%20empresas,una%20planta%20en%20Vynmsa%20Quer%C3%A9taro

- https://www.bbc.com/mundo/noticias-64590655

VI. Legal structures for investing in Mexico

There are various legal structures that an investor may adopt in order to carry out a business in Mexico. In general terms the foreign investor may choose to do business through either the incorporation of a Mexican subsidiary or by establishing a branch. It is also possible to carry out operations through trusts.

A) Mexican subsidiary

The Commercial Companies’ Law (Ley de Sociedades Mercantiles or “CCL”) allows various forms of entities, including the stock corporation (Sociedad Anónima, or “S.A.”) and the limited liability company (Sociedad de Responsabilidad Limitada, or “S.R.L.”). Also, the Securities Market Law (Ley del Mercado de Valores or “SML”) allows other forms of entities, including the investment promotion stock corporation (Sociedad Anónima Promotora de Inversión, or “S.A.P.I.”), as well as a public investment promotion stock corporation (Sociedad Anónima Promotora de Inversión Bursátil, or “S.A.P.I.B.”) and a public stock corporation (Sociedad Anónima Bursátil, or “S.A.B.”). The use of these types of entities is highly recommended because they limit the liability of the investors to the payment of their capital contributions, whereas branches and other forms of entities regulated by the CCL do not, as further detailed below.

The most commonly used forms of business organizations are the S.A.s and the S.R.L.s. Both SA and SRL provide limited liability to their individual shareholders or members (a minimum of two shareholders or members are required by Mexican law), although certain exceptions apply. Moreover, in certain cases, primarily when a joint venture relationship exists, and the shareholders intend to agree on special rights for minorities or to limit certain corporate and economic rights, a S.A.P.I. may be used. The S.R.L. may represent certain advantages as a pass-through vehicle for tax purposes, if the investors are tax residents in the United States of America, but provides for more stringent restrictions regarding capital transfers.

B) Branches and Representative Offices without Income

Instead of setting up a Mexican company, a foreign investor may establish a branch. Foreign companies duly organized under the laws of their place of incorporation are recognized as legal entities in Mexico; however, a branch itself has no independent legal personality and thus the foreign entity will be directly and fully responsible for all liabilities and undertakings of its branch in Mexico (e.g., no corporate shield will apply). In order to establish a branch, the investor shall need to file an application before the Ministry of Economy and meet certain requirements.

Under the Mexican Income Tax Law (Ley del Impuesto sobre la Renta or “LISR”), a branch operating in Mexico would be deemed to create a permanent establishment (“PE”) in Mexico, and therefore it is obliged to pay income tax with respect to all income (less deductions) attributable to such permanent establishment. In general terms, the tax regime applicable to permanent establishments is basically the same as the one that applies to a Mexican company.

Additionally, the investor may consider operating in Mexico as a “Representative Office without Income” (oficina de representación sin ingresos or “Rep Office”) that are authorized by the Mexican government in order to allow foreign entities to perform activities of a prior or auxiliary nature to those performed by a non-resident. In this regard, the performance within national territory of such activities by a non-resident are not considered to constitute a PE in Mexico.

Although the biggest advantage of this alternative lies in the fact that the branch and the Rep Office may be set-up without the need of forming a new company in Mexico, this may turn out in practice to be a time-consuming option due to the nature of authorizations needed to be secured.

VII. Foreign Investment

Mexico is open to foreign investment in most economic sectors and has consistently been one of the largest emerging market recipients of foreign investment. Mexico’s Foreign Investment Law of 1993 (Ley de inversión Extranjera or “FIL”) and its regulations oversees the sector. Unless otherwise provided for in the FIL, foreign investors may participate in any proportion in the capital of any Mexican corporation or partnership, enter new fields of economic activity, manufacture new product lines, open and operate establishments, and expand or relocate existing establishments. There are certain sectors reserved for the State (e.g., petroleum, electricity, and nuclear energy), sectors reserved exclusively for Mexicans and Mexican companies that use a foreign exclusion clause (e.g., domestic tourist and freight transport on land, not including courier services, and development banking), and sectors subject to specific regulations (manufacturing and trading of explosives, weapons and firearms). Where sector restrictions do exist, foreign direct investment is limited to 10% or 49%, depending on the industry.

The entity in charge of regulating foreign investment is the Foreign Investment Commission (Comisión Nacional de Inversión Extranjera, or the “Commission”). The Commission is responsible for decision making regarding foreign investment and the promotion of foreign investment in accordance with the law. A favorable resolution by the Commission is required in certain industries where foreign investment exceeds the permitted threshold (49%), or where foreign investment exceeds 49% of the capital stock of a Mexican company and the aggregate value of the company’s assets exceed a certain amount annually set by the Commission. Finally, companies with foreign investment (either at the moment of incorporation or by the subsequent admission of foreign shareholders) must register before the National Registry of Foreign Investments (Registro Nacional de Inversiones Extranjeras).

VIII. Tax Considerations

Mexican resident corporations are taxed based on the net taxable income and such amount is subject to the income tax rate of 30%. The net taxable income is obtained by subtracting from the aggregate income all of the authorized deductions and the employees´ profits distributions (“EPD”) paid during the year. Such net taxable income shall be reduced, as applicable, by the tax loss carryforwards from previous years.

Dividends paid by Mexican resident corporations are not subject to corporate taxation to the extent that the same are paid out of the after-tax earnings and profits account. Should that not be the case, the entity paying dividends shall pay income tax on the distribution of untaxed profits at a 30% rate.

Dividends paid to an individual that is a Mexican resident for tax purposes is subject to a progressive tariff (maximum 35%) of income tax rate, and said individual is entitled to credit the corporate tax paid by the entity that distributes the dividend and in addition, the individual shall pay income tax at a 10% rate, on the net amount of the dividend.

In addition, dividends distributed to non-resident shareholders, either individuals or legal entities, are subject to a 10% withholding tax on the net dividend paid. Double taxation treaties entered into by Mexico may provide for lower tax rates or, in some cases, an exemption, as well as the possibility to credit or deduct, in the country of residence of the recipient of the dividend, the tax effectively paid in Mexico.

IX. Labor and Employment matters to consider

A.- Labor. Before setting up a Mexican business venture, the consequences of the labor law such as compensation requirements, employment-related contributions, taxes and unions must be considered. The Mexican Federal Labor Law (Ley Federal del Trabajo or “FLL”) regulates the relationship between employer and employee, the relationships between unions and both employees and employers, as well as the activities of labor authorities.

The provisions of the immigration laws require that individuals and legal entities that hire foreign personnel, or that issue an offer of employment to a foreign individual, have to request a certificate of registration of employer from the National Institute of Migration (Instituto Nacional de Migración or “INM”).

B.- Collective Labor Relationships. Employees and employers have the right to form unions (sindicatos) and professional associations, or affiliate with existing unions or professional associations, with the approval of the Ministry of Labor and Social Welfare (Secretaría del Trabajo y Previsión Social, or “STPS”). A union is an association of employees or employers formed to study and protect their respective interests, which may associate among them to form federations and confederations. Such unions execute Collective Bargaining Agreements that will need to be registered before the labor authorities following their execution.

C.- Social Security. The Social Security Law (Ley del Seguro Social or “SSL”) regulates employer, employee, and government participation in the federal social benefit programs through the Mexican Social Security Institute (Instituto Mexicano del Seguro Social, or “IMSS”). The purpose of the SSL is to guarantee the human right to health, medical attention and social services required to obtain individual and collective well-being. Social security benefits are divided into mandatory and voluntary programs. Mandatory programs are the basic social security benefits for the employees set forth in the labor laws. Voluntary programs are optional to the provided by the employers and are granted at the discretion of the employer.

The most important obligations regarding private employment are to: (i) register each employee with IMSS; (ii) contribute to the mandatory federal social security programs; (iii) as the case may be, withhold the employees’ contributions in terms of the labor laws; and (iv) send employees’ contributions to their appropriate account.

D.- Housing Fund. The Workers’ Housing Fund Law regulates employer, employee, and government participation in the Mexican National Workers Housing Fund Institute (Instituto del Fondo Nacional de la Vivienda para los Trabajadores, or “INFONAVIT”). The employers fulfill their obligation by contributing to INFONAVIT through the payment to authorized entities of a determined percentage of each of the employees’ integrated salary. INFONAVIT, in turn, facilitates the employee financing him to buy, construct or repair a home, as well as to pay off housing loans.

E.- Employees’ Profits Distribution. Employees have the right to share in the profits of the company pursuant to the provisions of the FLL, which amount to 10% of the company’s profits before taxes. The FLL establishes the right of employees to receive a distribution of the company’s profits capped to the greater of: (i) the equivalent of 3 (three) months of salary of each employee, or (ii) the average of the profit sharing received by each employee in the 3 (three) previous years.

This mandatory provision applies for most businesses. Those exempt from such duty include, among others, (a) newly incorporated entities during their first year of operations; (b) companies dedicated to the production of a new product during their first two years of operations; (c) companies dedicated to an extractive industry during the exploration period, and (d) nonprofit organizations.

In principle, all employees have the right to share this profit, except for the General Manager. In order to determine the amount of employees’ profit distributions corresponding to each employee, a special commission should be incorporated within the company, integrated by representatives of the employer and the employees equally.

F.- Prohibition of Subcontracting Regime in Mexico. A recent legal reform to the FLL, approved by the Mexican Congress on April 2021, contains an explicit prohibition to subcontract employees either through insourcing or outsourcing systems, to the extent such employees are under the directions of the company receiving such services.

There is only one exception to the subcontracting prohibition which is contracting of specialized works or services, as long as such works or services are not a part of the corporate purpose or main activities of the contractor and certain requirements are met. This exception includes those entrepreneurial groups that have a complementary or shared services entity, which will be authorized to provide services to other companies of the corporate group, but also with the explained limitation related to the corporate purpose and activities of the companies receiving the services.

The use of an insourcing company for one or more affiliate operative companies, or a third-party outsourcing company to carry out activities different from the main activities and corporate purpose of the company, and/or simply using vendors that provide work or services using their own employees for your benefit, should be assessed to comply with the new provisions.

Non-compliance with subcontracting rules has important legal consequences that companies operating in Mexico must be aware of, such as: (i) substantial fines contained in different laws; (ii) joint liability for the payment of labor, social and tax obligations related to the subcontracted employees; (iii) non deductibility of income tax and no offset of the value added tax paid; and (iv) even criminal penalty for the commission of qualified tax fraud felony.

X. Location and Tax Incentives

When establishing manufacturing facilities in Mexico, there are a number of factors that need to be taken into consideration. In this case, it is necessary for the locations to have reliable infrastructure such as roads, ports, airports, as well as sufficient available and educated work force in the area along with local resources such as energy and water.

There are several good locations for setting up manufacturing facilities such as: (i) Tijuana and Mexicali in the western north on the California Borders; (ii) Chihuahua and Ciudad Juarez, last one across from El Paso, Texas; (iii) Monterrey in the northeast of Mexico; (iv) Guadalajara in the western part of Mexico; and (v) the Bajío States, composed by Queretaro, Guanajuato, San Luis Potosí and Aguascalientes. There are some other locations such as Puebla, Tamaulipas, Sonora, Coahuila and Yucatan.

In almost all of them, in accordance with their own local laws, the States are in a position to grant tax incentives by reducing or exempting from payment for a certain number of years as regards to the 2% local wages tax, or interconnection of water and sewage services or training.

XI. Real Estate

Companies in Mexico may either acquire land and build their own premises buy industrial premises or lease same.

A. Acquiring Real Estate

- There are certain restrictions when acquiring real estate along the border or on the coastline (“the Restricted Zone”). Outside the Restricted Zone there are no limitations.

- Acquisition of real estate due to the amounts normally involved will have to be formalized in writing in front of a notary public, which will require afterwards to be recorded with the Public Registry of Property where the real estate is located.

- Acquisition of real estate is subject to the Asset Transfer Tax and in the event of constructions to Value Added Tax.

- Prior to acquiring any real estate is important to verify it´s zoning use as well as any operational limitations.

B. Leasing of Real Estate

- There are no limitations as regards to the Restricted Zone.

- Maximum term of leasing contracts will vary from state to state in accordance with local Civil Codes.

- Leasing is subject to Value Added Tax.

- It is very customary for lessors to request lessees for guarantees or bonds.

XII. Anti-Money Laundering and Data Protection

The Mexican Anti-Money Laundering Law (“AML”) was approved by the Mexican Congress to protect the financial system and national economy, establishing measures and procedures to prevent and detect acts or operations that involve illicit assets, though an interinstitutional coordination, that has as an end to collect elements that are useful to investigate and prosecute the crimes of operations with illicit assets. The notary public that would incorporate the new entities may request information of the investments’ final beneficiaries.

Among other aspects, the AML establishes what are called ‘Vulnerable Activities’, which include gambling, issuance of credit and debit cards, construction or development of real estate, commercialization of jewelry and automobiles, notary services, and legal services, among others. Those who carry out Vulnerable Activities are subject to AML obligations, including but not limited to know your customer (KYC) practices and reporting to the Mexican Financial Intelligence Unit (Unidad de Inteligencia Financiera).

Additionally, there are certain requirements to be met in order to comply with the Data Protection Law, specifically when the companies recall information from their clients and workers. Such provisions include the proceedings to maintain the information unaltered, non-disclosure proceedings and obligations regarding the type of information that the companies are entitled to send to their clients depending in clients’ prior instructions.

For more information, please contact:

Tel: +5255 5282 9063

Torre Chapultepec Uno R509

Av. Paseo de la Reforma 509, 18th Floor, Cuauhtémoc, 06500 Mexico City.